Tech Giants Drop $40B on UK AI Infrastructure 🇬🇧 and Trump's H-1B Fee Opens Doors for Europe (If Brussels Can Move Fast Enough) 🇪🇺

VC Angle Weekly Update #18

Hey - welcome to the eighteenth edition of VC Angle Weekly Updates! As always, we're keeping tabs on what actually matters across 🇪🇺 European tech. If something broke the news this week and it's worth your time, it's probably below. Scroll on for the deals, roles, reads, and events you'll want on your radar.

In This Edition:

American giants drop $40+ billion on UK AI infrastructure while Trump's in town

Trump's $100,000 H-1B visa fee could be Europe's biggest talent opportunity

European AI funding jumps 600% but still short of US

EIB invests €260M in a deep tech fund

📰 What Happened This Week

Tech giants pledge $40B+ to UK AI infrastructure as Trump visits London

Microsoft, Nvidia, Google, OpenAI, and Salesforce announced over $40 billion in combined UK AI investments during Trump's state visit. Microsoft leads with $30 billion by 2028 to build the UK's "largest supercomputer," while Nvidia plans to deploy 120,000 Blackwell chips—its biggest European rollout.

Google commits £5 billion for a new data center, OpenAI launched "Stargate U.K." with plans for up to 31,000 GPUs, and Salesforce boosted its commitment from $4 billion to $6 billion. Trump and PM Keir Starmer are expected to sign a new AI collaboration deal Wednesday covering artificial intelligence, quantum computing, and nuclear technologies.

EIB commits €260M to Jolt Capital's €1B deep tech fund targeting European champions

The European Investment Bank anchored French fund Jolt Capital V with €260 million as part of the European Tech Champions Initiative's push to create European tech giants competing with Silicon Valley and Chinese rivals. Jolt targets deep tech sectors including AI, cybersecurity, semiconductors, and advanced materials—companies needing serious capital and time to reach profitability but can reshape industries.

The fund aims to raise €1 billion total, making it one of Europe's largest deep tech vehicles. The broader initiative has committed over €2.5 billion across 11 funds to prevent European startups from selling to American buyers or relocating overseas.

European AI funding jumps 600% in Q3 as Mistral deal signals catch-up with US… sort of?

Corporate funding for European AI startups surged 600% in Q3 2025 versus the previous quarter, largely driven by Mistral's €1.3 billion Series C led by ASML. The Dutch chipmaker's investment represents the largest corporate-backed round for a European AI company to date. Nvidia is also ramping up European bets, including a $500 million investment in UK self-driving startup Wayve and infrastructure deals across Britain.

Despite the growth, the US still dominates AI funding with mega-rounds like OpenAI's $40 billion raise. European AI rounds average $62 million compared to $267 million for US deals, but the gap appears to be narrowing as corporate investors increasingly view Europe as a viable alternative to Silicon Valley for AI investments.

Trump's $100,000 H-1B visa fee creates talent opportunity for Europe

Trump imposed a one-time $100,000 fee on new H-1B visa applications, causing panic among tech workers before the White House clarified it only applies to new petitions. The policy effectively prices out smaller companies and early-career workers, potentially driving skilled talent elsewhere.

This creates an opportunity for Europe, but former ECB president Mario Draghi warned this week that EU governments still don't grasp "the gravity of the moment" and the bloc's growth model was "fading fast." Only 11.2% of Draghi's 383 competitiveness recommendations have been implemented after one year.

🔍 Reads & Reports

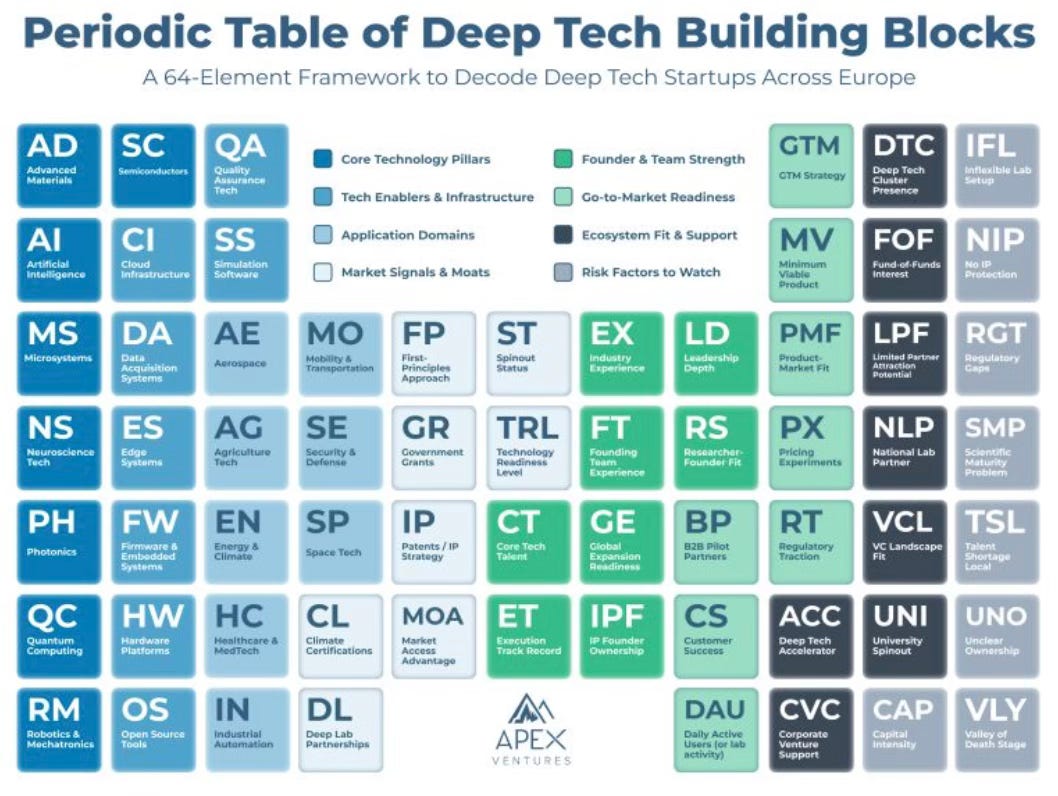

Apex Ventures creates "Periodic Table" framework to decode European deep tech startups

released a 64-element framework for evaluating deep tech companies, organized like a periodic table with categories spanning technology, infrastructure, market readiness, and execution. Founder Andreas Riegler argues successful deep tech companies must progress across multiple layers simultaneously—when one element lags, momentum stalls.

The framework gives founders and investors a shared language to distinguish genuinely breakthrough companies from those stuck in the lab without commercial viability.

EWOR template reveals 7 areas that make or break startup co-founder agreements

EWOR released a co-founder agreement template addressing the reality that startups fail from co-founder fallout, not bad ideas. The framework covers seven critical areas: (1) equity splits, (2) roles and responsibilities, (3) intellectual property, (4) compensation, (5) conflict resolution, (6) exit scenarios, and (7) legal compliance. EWOR emphasizes getting agreements in place before raising capital or launching products.

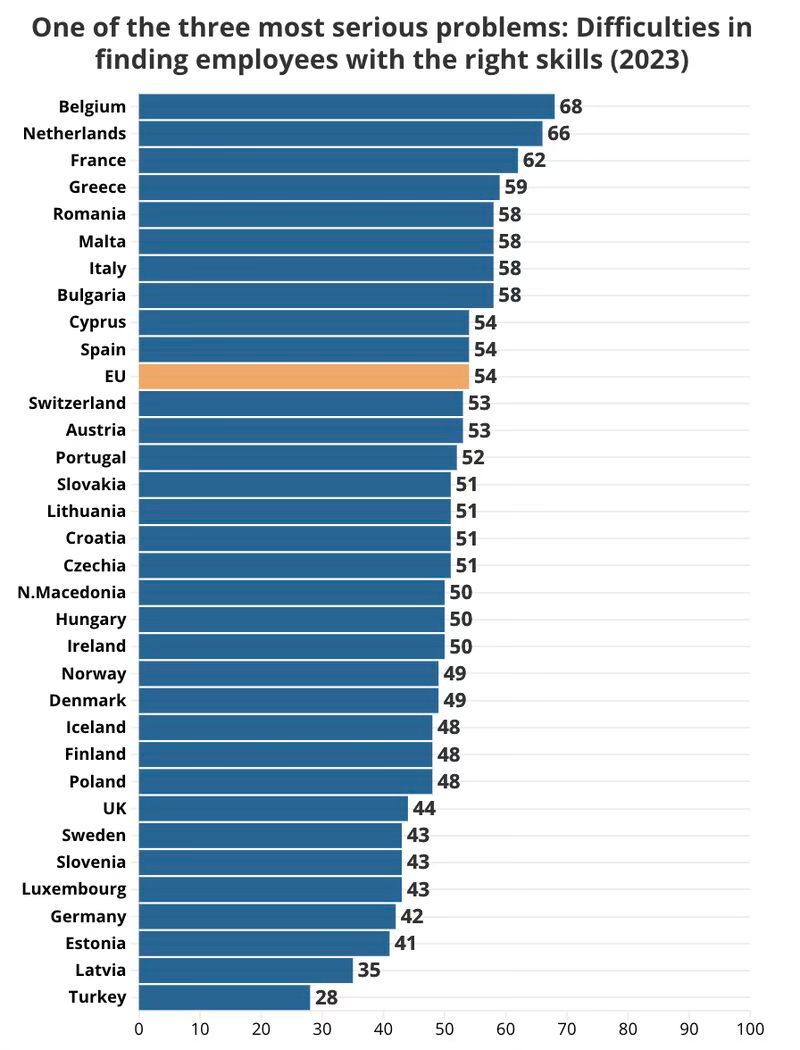

European skills shortage hits crisis levels as 54% of companies struggle to find talent

Europe's skills shortage exploded from 42% to 75% over five years—a 6.6% annual increase. Belgium leads the crisis at 68%, followed by Netherlands (66%) and France (62%). Even Germany (42%) and the UK (44%) struggle significantly.

The timing creates a paradox: as Trump's $100,000 H-1B visa fee pushes skilled workers away from the US, Europe has a golden opportunity to attract global talent—but first needs to fix its own systemic skills gap and education misalignment with market needs.

💶 Where Funds Went (Or Will Go)

Startups

🇬🇧 Nothing raises €170M Series C at €1B+ valuation

🇬🇧 Shop Circle extends Series B to €84M for AI-first e-commerce tools

🇫🇷 Cailabs raises €57M to scale deeptech photonics

🇸🇪 EvoluteIQ raises €44M to scale agentic AI platform

🇬🇧 Nory raises €37M Series B to automate restaurant operations

🇷🇴 DRUID AI raises €26M Series C to scale AI agents for enterprises

🇭🇺 SEON raises €63M Series C for fraud prevention & AML compliance

🇩🇪 BIOWEG raises €16M to replace microplastics

🇩🇪 Kertos raises €14M Series A for AI-first compliance

🇩🇪 Factor2 Energy raises €8.4M Seed for CO₂ geothermal power

🇬🇧 Plumerai raises €8M Series A for Tiny AI in cameras

🇫🇷 Genoskin raises €7.4M to advance human skin models

🇩🇪 Suena Energy raises €8M Series A for energy trading & storage integration

🇩🇪 feld.energy raises €10M Seed to accelerate agrivoltaics in Germany

🇩🇪 encentive raises €6.3M from General Catalyst to cut industrial energy bills

🇳🇱 Brineworks raises €6.8M to scale direct air capture for e-fuels

🇳🇴 Sonair raises €5.5M for ultrasonic sensors in robotics

🇪🇸 Altan raises €2.2M Seed for autonomous AI design platform

🤝 M&A

🇩🇰 Evertrace acquires 🇩🇪 Whisper AI (VC sourcing tools)

🇺🇸 Workday acquires 🇸🇪 Sana for $1.1B

🇦🇹 fonio.ai acquires 🇦🇹 fluently (AI phone assistant)

🇮🇹 Bending Spoons acquires 🇺🇸 Vimeo for $1.38B

🇸🇪 Opper AI acquires 🇸🇪 FinetuneDB (AI model tuning)

Investors

🇨🇿 Aspire11 launches €500M pension-backed fund

🇺🇸/🇫🇷 Quadrille Capital closes €500M to invest in EU/US tech

🇬🇧 BNVT Capital launches €126M debut fund for AI-first startups

🇵🇹 Shapers launches $75M fintech fund I

🇪🇪/🇸🇪 Outlast Fund closes €21M debut for Baltic–Nordic founders

💼 Open Roles

10x Founders → Tech Analyst/Associate in Munich, Germany. Apply here.

XAnge → Analyst in Paris, France. Apply here.

360 Capital → Visiting Analyst in Paris, France. Apply here.

Creandum → Visiting Analyst in London, UK. Apply here.

No Such Investor → Analyst/Associate in Amsterdam, Netherlands. Apply here.

👋 That’s a wrap for this week.

If you’ve got a round, role, or resource others should see, reply to this or ping us at hello@patrons.vc or send me a message on LinkedIn. We’re building Europe’s finest scouting network at Patrons. If you have a good deal flow, want to expand yours, or want to reach the right investors, send us a message!

If you found this useful, send it to a founder or friend who’d appreciate it.